What is a Credit Bureau? and How Does It Work?

Forty-five percent of people in South Africa report they do not know how credit reports come into being.

It is likely that you are like many consumers; you are aware of what a credit score or report is but have no idea what a credit bureau is. There are four major credit bureaus in South Africa that keeps track of your credit information.

Credit providers then use these to determine a particular prospective customer's creditworthiness.

A credit bureau's primary function is to observe the actions of consumers with respect to credit information and accurately translate these actions into measurable and reasonably accurate figures. It, therefore, ensures that any credit provider registered with the NCR can accurately determine the degree of risk associated with a particular consumer.

It is a game of numbers, and from the perspective of the credit provider, it is one of the most crucial steps in their process of due diligence. It is common for credit providers to feel more inclined to refuse a new loan application if a credit score drops.

We have previously mentioned that South Africa has four main credit bureaus: Experian, TransUnion, XDS, and Compuscan. Let us take a closer look at what these companies do and why they are crucial to the South African economy.

What Is a Credit Bureau?

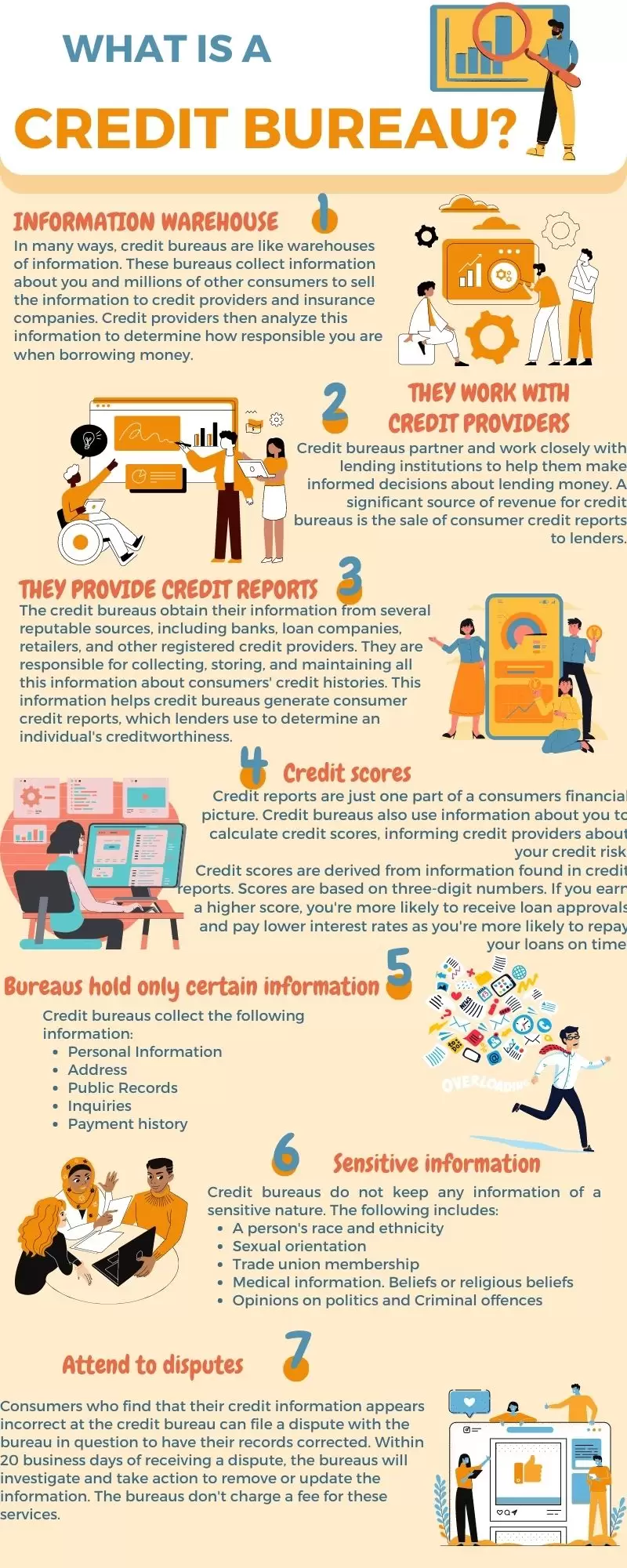

It would be helpful to start with the repositories of consumer credit information, namely credit bureaus. The primary purpose of these credit bureaus is to provide information and analysis of the consumer's credit behaviour primarily for the benefit of credit providers like the six banks, store companies, loan providers, service providers like telecommunications companies and other registered financial institutions.

The credit bureaus obtain their information from several reputable sources, including banks, loan companies, retailers, and other registered credit providers. They are responsible for collecting, storing, and maintaining all this information about consumers' credit histories. This information helps credit bureaus generate consumer credit reports, which lenders use to determine an individual's creditworthiness.

What is the Purpose of a Credit Bureau?

Credit bureaus partner and work closely with lending institutions to help them make informed decisions about lending money. A significant source of revenue for credit bureaus is the sale of consumer credit reports to lenders.

With the help of these purchased credit reports, financial institutions determine whether an individual is a suitable candidate for a loan and what interest rate to charge.

It is also common for insurance companies to use credit information about policyholders when determining premiums and evaluating claims. Employers use credit reports to screen applicants for positions in the financial sector.

It's important to understand that while credit bureaus undoubtedly play a significant role in our financial lives, they are not government entities. Nor are they a non-profit business. The business model of these for-profit companies is to sell consumer data.

There are many reasons why it is so important to know what is in your credit reports and that you ensure that the information is accurate. There can be significant repercussions if there are errors in your report, whether they will affect your ability to obtain a home loan, rent a house, or even land your dream position in a prestigious company.

Common Myths About Credit Bureaus

There are two myths associated with credit bureaus which we have already busted.

They are privately registered and owned, and they are neither government entities. They are in business to make profits for their shareholders. Let's look at a few more.

Myth #1

All your personal information, including your income and race, is recorded, and tracked by credit bureaus.

The statement is false. Credit bureaus only collect information about your credit-related activities, such as whether you pay your monthly accounts and service agreements on time, how much debt you have and what type of credit products you have. However, there are certain things they do not track, for instance, race, what your bank account balance is or how much money you earn.

Myth #2

You only get a credit report if you have a good credit history.

This statement is also false. Any consumer who has ever applied for a loan or had a credit card has a credit history and a credit score. Even if you have never been late on a payment, your credit reports will still show up when credit providers request your report.

Myth #3

A free credit report is only available once a year.

This statement is another myth. You have the right to receive a free report from each bureau every twelve months. For example, if you check your Experian report and find an error, you can also request a free report from Compuscan and TransUnion to see if there are any errors on those reports too.

Myth #4

You can damage your credit score by checking it yourself.

This statement is false. When you check your report or credit score, you do not affect your score. The only time your score affects you is when a lender assesses it as part of the qualification process for a loan, home loan, vehicle finance application or credit card.

Myth #5

If you miss payments on your debts, you will get blacklisted.

This statement is another popular myth. The credit reporting bureaus do not maintain a blacklist of consumers who defaulted on their repayments. A surprisingly common myth that has existed for an exceptionally long time is the term blacklisted. It refers to a self-made belief that if you fail to make any payments on any of your debts, you will not be able to access credit facilities in the future.

The credit providers will evaluate your report and score whenever you apply for credit. These factors will influence their decision about whether to approve your credit request. Credit providers decline your application because they do not believe you have met their minimum criteria to qualify for additional loan facilities and not because your name appears on a dreaded blacklist.

Myth #6

A higher income leads to a higher credit score.This statement is another myth. The amount of money you earn has no bearing on your credit score. It is not how much money you have available to pay your accounts that determines your credit score, but how well you pay your credit agreements. Your bureau report and score may improve if you pay off your outstanding debt and earn a higher salary. Even if you receive a modest income and have a good repayment profile, your credit score may be better than those earning higher incomes with poor payment profiles.

Article continued after the Infographic.

The Main Credit Bureaus in South Africa

Having clarified some common misconceptions about credit reporting bureaus, let's take a closer look at the four main credit bureaus based in SA. These are fully registered member credit bureaus, meaning they have access to a wide range of data sources and are subject to strict regulatory requirements under the National Credit Act.

The following section will concentrate on the four credit reporting bureaus whose services tend to be the most widely used by credit providers in South Africa. These credit reporting bureaus are out of the eighteen credit bureaus in existence in the country.

With over 40 years of experience, Experian has established itself as one of the world's largest credit reporting bureaus. Globally, they operate in thirty-six different countries.

It is pertinent to note that Experian South Africa offers consumer and business credit reports. These services are readily available at your fingertips in an easy-to-understand format.

Another widely used global credit bureau, TransUnion, has been around for more than one hundred years and has a reputation for providing accurate and timely credit information. On an international scale, they have access to data on approximately 18 million consumers and over 3 million businesses.

The headquarters of the TransUnion organization lies in Chicago, United States of America, but the company also has offices in twenty-two other countries around the world.

XDS stands for Xpert Data Solutions and is a local credit reporting bureau completely 100% independently black-owned. They are the largest locally owned credit bureau in South Africa.

It is a member of the EOH Group, which operates in more than fifty countries across the globe.

Another credit bureau that does business in South Africa is Compuscan. The company has been operating for over 25 years and has its headquarters in Stellenbosch, South Africa.

What information does a credit bureau collect?

It is essential to understand that credit bureaus are registered independently. Most credit decisions and assessments rely on information gathered by XDS, TransUnion, Compuscan and Experian, the four main credit bureaus. Credit bureaus collect the following information:

1. Personal Information

Credit bureau companies use your personal information to identify you, so they can distinguish you from other borrowers who may be applying for credit. The following personal information is collected:

- Full names and Surname

- Physically address as per proof of address document.

- Date of birth

- Identity number

- Previous addresses

- Employment history

2. Public Records

The only public records appearing in credit reports are sequestrations, administration orders, debt review indicators, and judgments.

3. Inquiries

As soon as a consumer applies for a new credit facility, the credit provider will request a report from the bureaus to assess the risk involved for the consumer. This newly recorded inquiry will appear under the section inquiries. Your report will show these inquiries for one year. Your credit score will be affected if you apply for numerous new credit applications within two weeks.

4. Payment history

Payment histories are records of all your credit agreements, loans, home loans, and other services, and they are the most crucial information credit bureaus collect. About 35% of your credit score stems from the information gathered from this section.

Each loan has several vital characteristics. They may go by a variety of names, but the general attributes are as follows:

- Creditor name

- Account number

- Account type

- Date account opened

- Current Balance

- Date Of Current Balance

- Account status

- Date of Account Status

- Credit Limit

- Monthly Installment

- Last Payment Amount

- Last Payment date

- Arrears Amount

If you are more than 30 days in arrears, the arrears amount, and last payment date will adversely affect your credit score. Your credit score will suffer if you do not resolve your arrears as soon as possible.

What information does not appear in your bureau report?

Credit providers want to know how you manage your debt when the time comes for you to apply for a home loan, vehicle finance, or loan. As discussed earlier, credit reports provide credit providers with a detailed record of your relationship with past and present debt obligations, how much debt you have, and how well you manage your debt. You will find your personal information in the report that helps verify that the information in the bureau report is related to you.Credit reports do not include the following sensitive information:

- Marital status

- Medical and disability information

- Bank account balances

- Criminal records

- Educational details

- Income

- Race and Ethnicity

- Sexual orientation

- Trade union affiliation

- Opinions on politics

- Investment portfolio

- Purchase records, such as what type of car you bought

Old information

Even the most relevant financial information will inevitably become outdated at some point in time. Consumer credit information is permitted to appear on consumer credit reports for a maximum period prescribed by the National Credit Act. The National Credit Act sets the maximum retention period for credit bureau information. The following information should automatically drop off your bureau report as it expires:

- Credit Enquiries. One year.

- Payment histories. Five years.

- Classifications of adverse enforcement actions. One year or 14 days after settlement.

- Debt Counselling. Once a clearance certificate is issued.

- Judgments. Five Years or until paid.

Checking Your Credit Report

It has already been mentioned in the previous paragraph that you are entitled to one free report from each credit reporting bureau once a year. In most cases, the process involved in requesting your credit reports in South Africa is straightforward to follow.

You can either request your report online or by mail. You can choose either of these options from the respective credit bureau's website. The information you need to provide to request your report will include some of your personal information, such as your name, address, email address, and a copy of your ID card. The credit bureau report should be sent to you within a few hours after making the request.

If you'd prefer to request your credit bureau reports by mail, you can send a letter with your full name, ID number, physical address, and contact details to the credit reporting bureau's postal address.

It's important to remember that you are entitled to one free bureau report per year from each credit bureau. You will have to pay a fee if you request a copy of your credit report more than once in 12 months.

Errors on Your Credit Report

Acting as soon as you find an error on your credit report is extremely important if you want to repair your credit score. Why is that? Having errors in your credit report or any other negative information that it contains can result in you being denied credit or even offered less favorable terms, such as an increased interest rate.

As a first step, you will have to initiate an investigation with the credit reporting bureau. As a result, the credit bureau will subsequently contact the lender or service provider concerned and ask them to verify the information displayed on your credit report.

It is possible to have inaccurate information removed from all your credit reports if it turns out to be erroneous.

You can also dispute any information in your bureau report that you believe is incorrect. The data includes information about delinquent payments, defaults, and insolvencies. If you wish to do this, you will need to send a written request to the credit bureau, accompanied by any documents that may be required.

Upon receiving the disputed information, the credit reporting bureau will investigate it within twenty business days and issue a response. There will be a correction to your credit report to remove the disputed incorrect information listed on your credit bureau reports.

How To Address a Bad Credit Report

If you've found your report isn't quite where you want it to be, there are several steps you can take.

As a first step, you will want to look carefully at your credit report and determine if you have any negative items. The types of credit score damaging listings that need to disappear from a bureau report include delinquent payments, defaults, and sequestrations.

Identifying the negative items in your report will allow you to start working on removing them to improve your bureau report. A person who owes their creditors outstanding money may have to negotiate updated terms or repayment plans.

Making payments monthly on time without fail and keeping your balances low can help you build your bureau report and scores. The fact that you are trying to improve your credit score means that you should live within your means and manage your finances accordingly.

If you follow these steps regularly, you have the potential to improve your credit score and create a healthier financial future for yourself over time. Read more on the Consumer Protection Act and your rights as a consumer.

You can improve your credit score in several proactive ways, one of which is to work with a credit bureau clearance organization, such as Credit Salvage, which can assist you in clearing your credit bureau reports from all major bureaus.

Keep Your Credit Report Healthy

So, What is a Credit Bureau? Being familiar with what a credit reporting bureau is and how it works is a crucial and essential part of managing your finances.

With your new understanding of the role that credit reporting bureaus play in your credit history, you will be able to ensure that the information in your report is accurate and up to date. In addition, you can also use this knowledge to start building a good credit history that you will be able to use in the future to your advantage. By following these tips, you can help to create a bright financial future for yourself.

Do you prefer having someone who specializes in credit bureau clearance assist you through this process and help you improve your bureau score? Identifying credit score crushing listings, credit bureau clearances, default listing removals, and debt review removals are only a few of our services. You can apply online for our service by completing our easy online application today. Customer satisfaction is our top priority. We work quickly, professionally, and efficiently.