Credit Clearance. Clear Your Credit record and improve Credit Scores

Get a Credit Score and Credit report you deserve!

The Credit Salvage Credit Clearance program is only for those who are serious about credit improvements and for those that are willing to commit to a clear credit record. Our processes are all about demonstrating to prospective credit providers and lenders that you can be responsible for your finances. Consumers are unaware that Credit providers analyse credit scores and will only assess applications where credit scores fall in low-risk categories. These credit providers will also analyse and scrutinise your ability to service current debt obligations. You now have the opportunity to remove or update old adverse accounts, whilst we assist you in building a new credit profile!

Open the door to a world of endless possibilities

Imagine a world in which your financial past does not determine your future opportunities. A place where financing a new car, acquiring a personal loan, or purchasing your dream home is not just a possibility, but a reality.

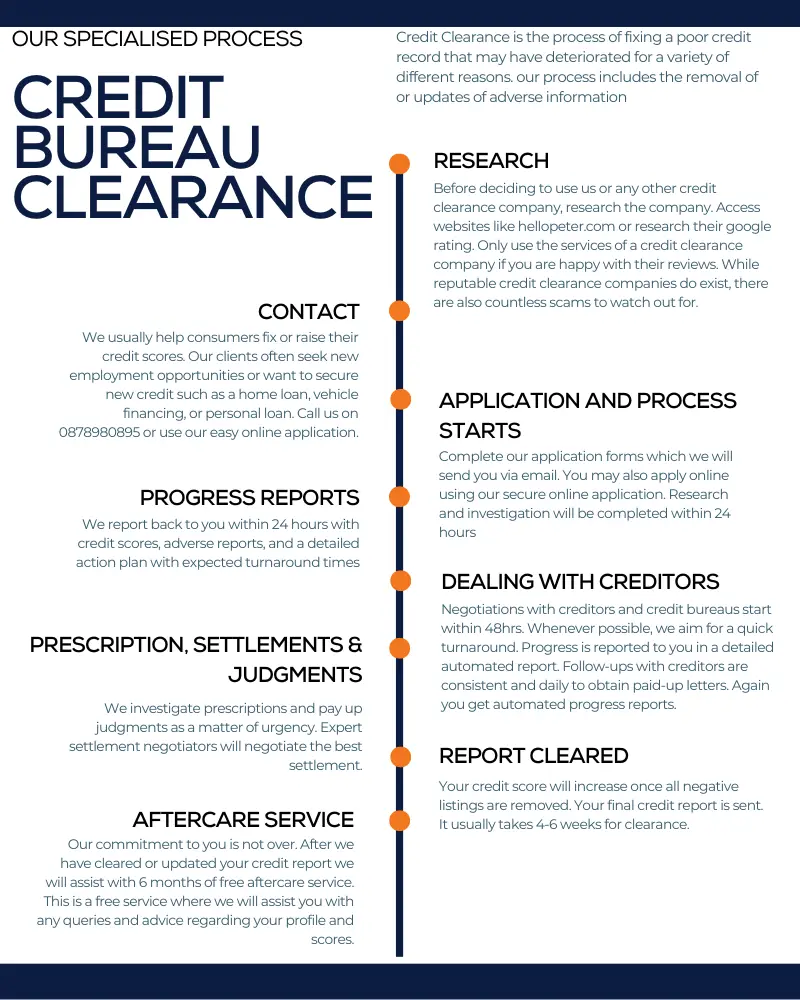

With our Credit Bureau Clearance services, you can turn this dream into a reality. Our team of experts will help you develop a plan to clear your credit history and build a positive credit score. We provide personalised guidance and support throughout the process. With our services, you can take control of your finances and reach your financial goals.

What makes us different?

How Our Credit Clearance Process Works

Expert Guidance:

Tailored Solutions

Fast results

Peace of Mind

Credit Clearance in South Africa

Investigations and analysis

We approach all major bureaus in South Africa to thoroughly analyse your credit profile and credit scores. A report with an action plan is discussed with you. Once accepted and agreed upon the credit clearance process will start.

Credit Clearance and Debt Review Removal

Your credit report is extremely important, and it will impact on your ability to get credit. This includes buying or renting a house, getting new employment opportunities and many other important things in life. After we have done our analyses of your credit reports with all the credit bureaus, we will make sure that what’s in your report is 100% correct. We will attend to the removals and updates of paid adverse accounts. We also do prescription investigations and investigate and remove unlawful credit inquiries. Apply Online here for our credit clearance and credit bureau clearance services.

We are a registered debt counselling firm and credit bureau report repair specialist, and some of our customer testimonials can be found here.

Monitoring

After you have been cleared with all the credit bureaus we will monitor your profile if you so wish and will assist with any needed future assistance free of charge.

"Your Credit Report and Credit Score are two of the most vital aspects of your Financial Health" Erin Lowry

Benefits of using our service

Let us take care of your creditors

So you had financial difficulties in the past that affected your ability to honour your obligation towards creditors and these creditors hand you over to debt collecting agencies and lawyers.

It is horrible receiving phone calls during working hours and you have to give them a commitment right there and then while everybody is listening in the office that you promise to pay a certain amount a month. Even worse is when you are exhausted and you get home from a busy day at the office and just as you are in the middle of your family supper the phone rings and guess what it's the inexperienced debt collector on the phone trying to make their target without listening to reason.

It is irritating and degrading and not to mention the unpleasant demand letters from lawyers. Unfortunately, the problem will not go away by simply ignoring it instead the problem will just get bigger and you will land up with extra interest being charged and the dreaded legal fees. In the end because of the contract that was signed years ago with all that small print you will have to pay and if it does not get paid you will possibly land up with your possessions being taken away, garnishee orders initiated against your salary or even your house being repossessed.

Register with us and we will help you take care of your creditors

Once you take the first step by registering with CREDIT SALVAGE NCRDC 2338, we will immediately contact each of your creditors, individually, and let them know that we are in the process of clearing your name of any judgments with the local credit bureau and let them know of your interest in settling your outstanding debt with them. Negotiating and reaching a settlement usually takes several phone calls and communication between us and the creditor and yourself. Throughout the program, we communicate with your creditors, on your behalf, and you will no longer be dealing with burdensome phone calls and letters from your creditors. Our main goal, as it is our company's mission statement, is to clear up all judgments that you might have. We work only for our clients, not for the benefit of the creditors. It is the first step to becoming financially secure, and debt settlement may be your best option with credit clearance.

We're confident and our experience has shown that this Credit Clearance is the best solution for many blacklisted consumers. However, we also fully understand that our debt negotiation and our credit clearance service is not for everyone, so let us give you an analysis and see if you qualify and find out whether the service we provide is right for you. If our services aren't eligible for you or don't fit your situation, we'll even go out and find and refer you to a company that can better service your needs.

Credit ClearanceStepBy StepGuide

Credit Clearance Process

STEP 1 - APPLICATION

All blacklisted clients who are interested in our services will complete our application form which will include

- Credit bureau consent

- Power of attorney

- General information

With this information, we can speedily proceed with the credit bureau clearance and debt review removal process. Read more here about:

How much does it cost to remove debt review

How Credit Salvage helps you remove the Debt Review Flag

STEP 2 - Credit Checks

In order to start the Credit Clearance process, we will obtain your personal credit profiles from all the various Credit Bureaus, TransUnion ITC, Experian, Compuscan and XDS. We will also obtain your payment profile from the NLR (National Loan Register). From these records we will exactly see what to do in order to clear your name from the various credit Bureaus.

We advise you accordingly and send you your profile for your own records. We establish and report on how many listings reflects on your personal profile. We also assist in setting up of a monthly budget if needed.

During the entire process, you will be kept up to date on progress by way of our world-class progress report system. This process we aim to complete within 24 hours.

STEP 3 - Prescription investigations and dealing with creditors

On receipt of a signed power of attorney, we will be able to do a thorough credit bureau investigation and we will advise you which companies have listed you as a bad payer. At this stage, we will establish which accounts qualify for prescription. During this period, we investigate all default enforcement action listings and attend to the removal of default listings where the creditor has not issued a compulsory section 129 demand letter.

Accounts that do not qualify for prescription need to get settled. We will negotiate on your behalf for a reduced settlement amount. In cases where you unable to settle the account via a compromised settlement, we will then proceed with an affordable payment arrangement to stop any further legal action.

Turnaround times around 7 days for settlement negotiations to be concluded.

STEP 4 - Creditors

We contact your creditors who have blacklisted you and establish if there is an outstanding amount due.

You will be notified via a comprehensive progress report of feedback.

STEP 5 - Judgments which have been settled

All the listings which have been paid in full we will immediately send those creditors our legal documents for them to sign. The creditor will sign these documents and send back to us in order to apply for a rescission of judgment. Once we have received the original documents and a court file our attorneys will then apply for a court date and apply for a rescission of judgment. Because it is motion you don't need to appear in court we will do everything for you. Once the judge has gone through the necessary documents a court order will be issued to rescind the judgment. With this document which we will receive will then be forwarded to the various credit bureaux to permanently remove the listing from their database. A copy of the court order will also be forwarded to you for your records.

STEP 6 - Judgements which still has a balance

All the listings which still have an outstanding balance we can then arrange a loan facility for you to pay off these creditors. We can't proceed further until the debt in question has been paid in full. Please see our loan products for the process. Once the loan has been approved we then negotiate on your behalf a better settlement amount. Once we have received confirmation of the new settlement amount the debt will then be paid. Once the debt has been paid in full the above mentioned step (number 5) will then be followed to obtain the rescission court order. Once you have been cleared form the adverse listings we will then assist with a home loan application.

Frequently Asked Questions on Credit Clearance

Credit clearance or Credit Bureau clearance is the legal process of removing negative listings from your credit profile such as defaults, judgments, or outdated debt so you can qualify for credit again.

Credit Salvage: Your Bridge from Burden to Breathing Easy

Credit Clearance or Debt Review Removal

or call us for more info

087-898-0895

or email us on

info@creditsalvage.co.za