What is debt counselling or debt review?

Have your personal financial circumstances changed for the worse which have caused you to miss your agreed monthly payments to your credit providers? Are you in a tight critical financial situation? We all experience those times in which we just can’t afford to pay for monthly living expenses and monthly creditor payments. Debt counselling will be a great idea because you will be provided with a professional support system to help you navigate your way out of your stressful financial situation. Our debt counselling program will ensure we work with you and your creditors to create a financial plan to get you out of debt.

So, what is Debt Counselling and Debt review?

Debt Counselling or alternatively known as Debt Review is a formal legal process that provides for a consumer to be declared over-indebted. Debt Review is a regulated process whereby a debt counsellor negotiates on your behalf, with all your creditors, to have the term of each credit agreement extended and the instalments reduced. Your debt counsellor may also appeal to your creditors to reduce the interest rate/s on your credit agreements so that you can afford to pay off all your debt as soon as possible. Simply put, Debt Counselling is a legal process that is solely designed to help consumers who are over-indebted to easily manage their monthly repayments to credit providers.

In terms of legislation Debt review protects your assets from Credit providers and it is designed to improve a consumer's financial situation.

How does Debt Counselling work?

A registered debt counsellor will discuss and assess your financial and debt situation. If you are declared over-indebted, you will be able to make use of all the benefits of the debt counselling process.

You will have a single consolidated installment to pay for all your debts.

To read more about debt counselling or debt review

Registration of Debt Counsellors

If you can no longer afford to pay your debts, our debt counselling service can assist. For many reasons like recession, changing conditions and others, consumers find themselves in a debt trap and can no longer pay their monthly debt repayments. These consumers are over-indebted and find it difficult to survive from month to month. Consumers in this scenario should not hide, feel despondent or feel desperate; there is a debt relief measure that will provide relief. This debt relief measure is debt counselling which. Registered debt counsellors will provide this service.

It is important to only use a debt counsellor who is a registered individual to provide the service of debt counselling.

For your convenience, we have attached the section of the act that is about the registration of Debt Counsellors

Section 44 of the National Credit Act - Registration of a debt counsellor

(1) A natural person may apply to be registered as a debt counsellor.

(2) A person must not offer or engage in the services of a debt counsellor in terms of 25 this Act or hold themselves out to the public as being authorized to offer any such service unless that person is registered as such in terms of this Chapter.

(3) In addition to the requirements of section 46, an applicant for registration as a debt counsellor must-

(a) Satisfy any prescribed education, experience, or competency requirements, or

(b) be able to satisfy within a reasonable time such requirements as the National Credit Regulator may determine as a condition of the applicant’s registration.

Using a company or an individual who is not registered in terms of the Act

It is important to only use registered debt counsellors as they get audited by the national credit Regulator and the Credit Act once or twice a year.

Companies who are not registered, will not be able to provide this service and will in all probability run away with your hard-earned money.

Investigate the registration of these companies before signing up. We're registered with the National Credit Regulator. We also make use of a registered payment Distribution Agent. Contact us today, for debt counselling services and get the peace of mind that you will be debt-free in the foreseeable future.

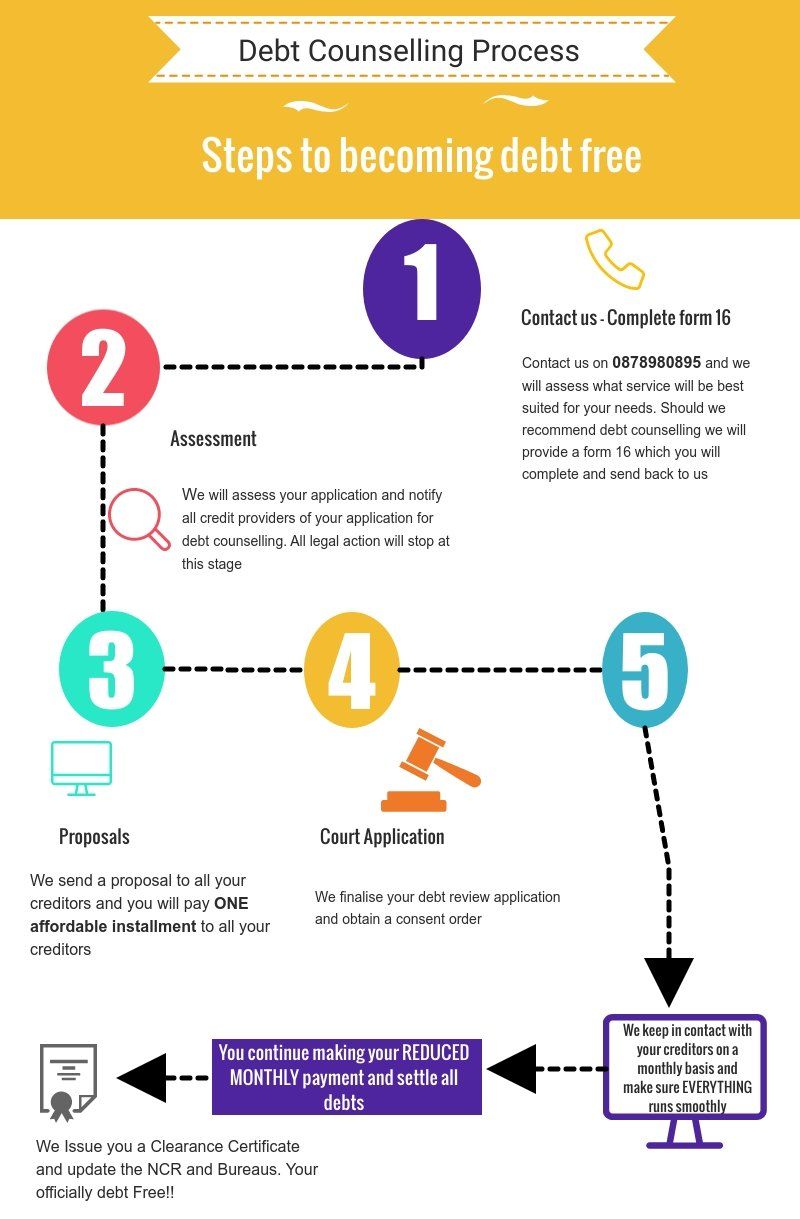

Debt CounsellingStepby StepGuide

The Debt Counselling Process:

In terms of the National Credit Act (NCA) you may formally apply to a Debt Counsellor for debt relief if you are unable to meet your financial commitments under credit agreements on a monthly basis. We as your registered Debt Counsellor must first assess if you are over-indebted. The following process will be strictly followed as laid down by the National Credit Act (NCA) :

STEP 1

You will provide details of your income, monthly budget, and debt commitments to us as we are registered Debt Counsellor. It is important to only give out this confidential information to only a registered Debt counsellor. To speed up the process you will need to give us copies of your pay slip, ID, and the latest statements of all your credit agreements or debt obligations. At this stage you will apply for a debt review.

We are a registered debt counselling firm and credit bureau report clearance specialist, and some of our customer testimonials can be found here

STEP 2

We as a registered Debt Counsellor will then do an initial assessment to check if you are indeed over-indebted.

We are a registered debt counselling firm and credit bureau report repair specialist, and some of our customer testimonials can be found here - testimonialsfound here - testimonials

Are you blacklisted? Click the following link to read all about blacklisted, credit reports and credit scores: what you need to know

STEP 3

We as the debt Counsellor will verify your budget and your existing debt commitments. We will formulate a new budget which you will have to agree upon to determine the amount available for debt repayment. At this stage we the debt Counsellor will also provide you with details of all the costs involved in terms of Debt Review, as well as an interim debt repayment plan in terms of the debt review process.

STEP 4

We as the Debt Counsellor will then contact all of your Credit Providers as well as the Credit Bureaus to verify your debts. In terms of the National credit Act You will also be noted on the Credit Bureaus as being under Debt Counselling and that your debt is in the process of being restructured. The notice will remain there until you have repaid your debts in full or where a court has deemed you not being over committed anymore (if in the case your personal circumstances changes). We the Debt Counsellor will then, where possible, negotiate the proposed restructured debt repayment plan with your Credit Providers.

STEP 5

If Credit Providers accept the proposed debt repayment plan, it will be made an order of the court by the local Magistrate's Court, referred to as a "Consent Order". However, if one or more of the Credit Providers do not accept the proposed debt repayment plan, the Debt Counsellor will have to submit it to a Magistrate for an order in terms of the National Credit Act.

STEP 6

We, your Debt Counsellor, will provide you with a final reduced debt repayment plan, which is then submitted to a Payment Distribution Agency (PDA). The aim of this is to collect a single payment from you and ensure that the correct amount in terms of the final debt repayment plan is paid to all your Credit Providers monthly. This will continue until all your debts have been paid in full, together with interest and legal fees, where applicable

More on what Debt Review is, and the process can be found in our blog entry Debt Review - Everything You Need to Know.

Benefits of using Our Debt Counselling Service

- We negotiate on your behalf the lowest interest rate.

- Once we start the process we guarantee fast service;

- Explain to you in detail each step of the process;

- We offer professional advice and assistance in the whole process;

- We provide a better chance of success;

- Detailed statements each month in terms of the NCA;

- We offer a range of additional services to help with other needs during the debt review process.

- All your creditors (the companies you owe money to) have to stop calling you and deal only with your debt counsellor;

- Our values are based on openness, honesty, social responsibility and caring for others is, in essence, the core of our business and it’s the only way in we which we provide our service. We offer transparent fees strictly in line with the National Credit Act and offer regular communication during the debt counselling process;

- You will be protected from legal action for a period of 60 days from the day of application and after the arrangement has been ended/decided as long as you pay according to the new arrangement. Read more about the debt review process here

The Following is needed for DEBT REVIEW:

Personal Information

All information including banking details

Bank Statement

Full 3 months bank statements

Payslip

Payslip from your current employer

Financials

(where applicable if self-employed)

ID Documents

Your valid Identity Document

Marriage Certificate

(if you are married)